- Report ,

- Insurtech

- July 13, 2022

Underwriting Insurtech: Capitalizing on an Emerging Industry

Introduction

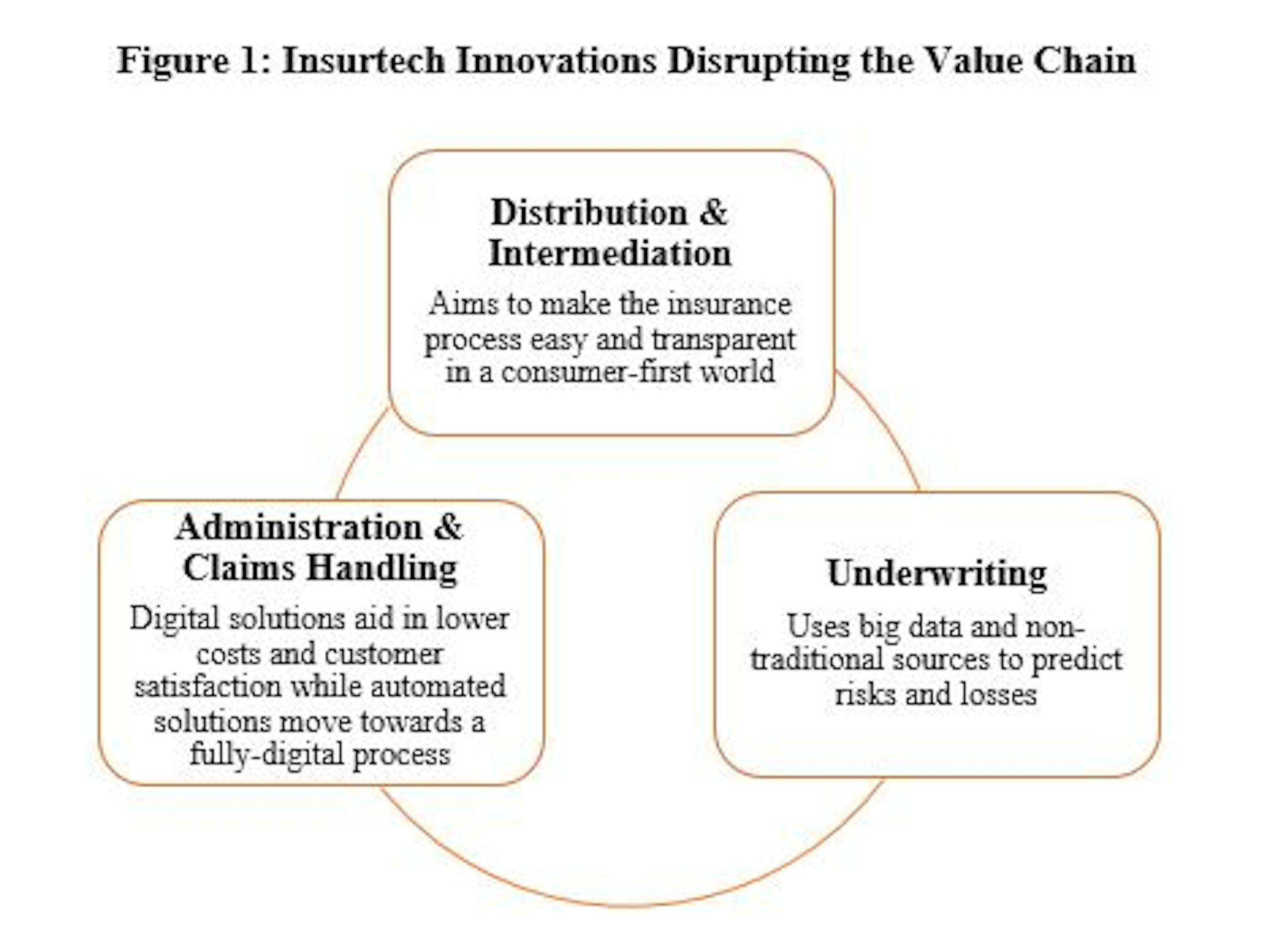

The traditional insurance market is highly mature and, like most mature industries, features significant growth potential through innovation and digital transformation. With the recent emergence of technology-forward entrants, incumbents (legacy insurance technology providers and insurance companies) recognize that technological advancements are critical to remaining competitive. Given the entrenched nature of the industry, incumbents must proactively look to implement new technology, as they increasingly face new competition in the form of startups. Insurtech companies, which broadly offer innovative technology-enabled solutions to consumers and providers, are rapidly changing the insurance landscape, often collaborating with incumbents – one of many unique elements to this emerging category. Insurtech will undoubtedly generate attractive investment opportunities, but the distinctive nature of the category requires deep knowledge and engagement.

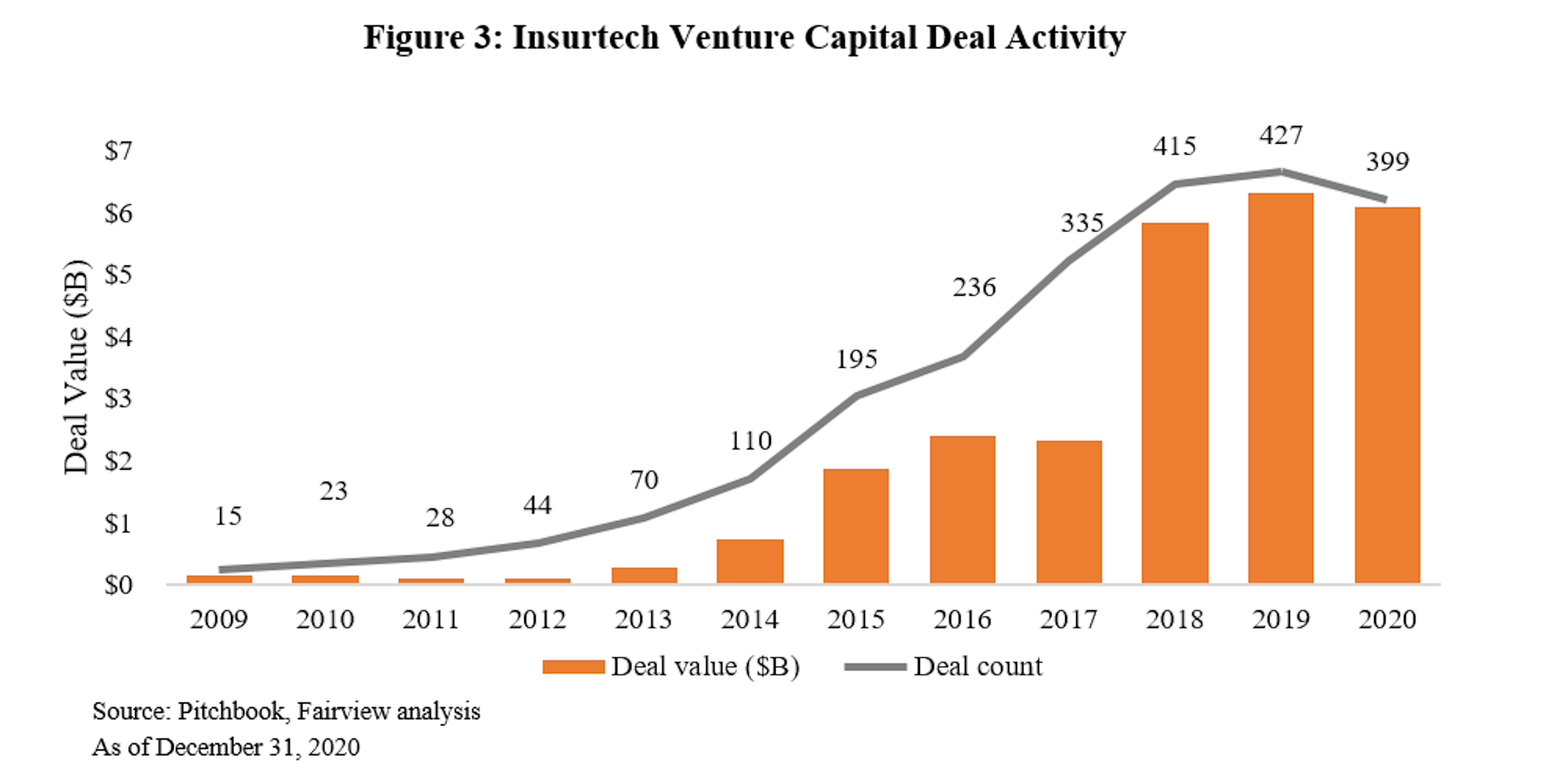

Insurtech, a subset of the fintech market, has accelerated rapidly in recent years. As these companies begin to develop and generate significant value, they have increasingly garnered investor attention. In 2020, insurtech companies received $6.1 billion in venture funding across 427 deals globally.[1] The insurtech market includes technology providers (offering platforms, analytics, and other technology-based services) and insurance providers (offering consumer-friendly and data-driven insurance policies). To date, insurtech has been most prevalent in the underwriting, distribution & intermediation, and administration & claims segments of the insurance value chain.

Market Opportunity

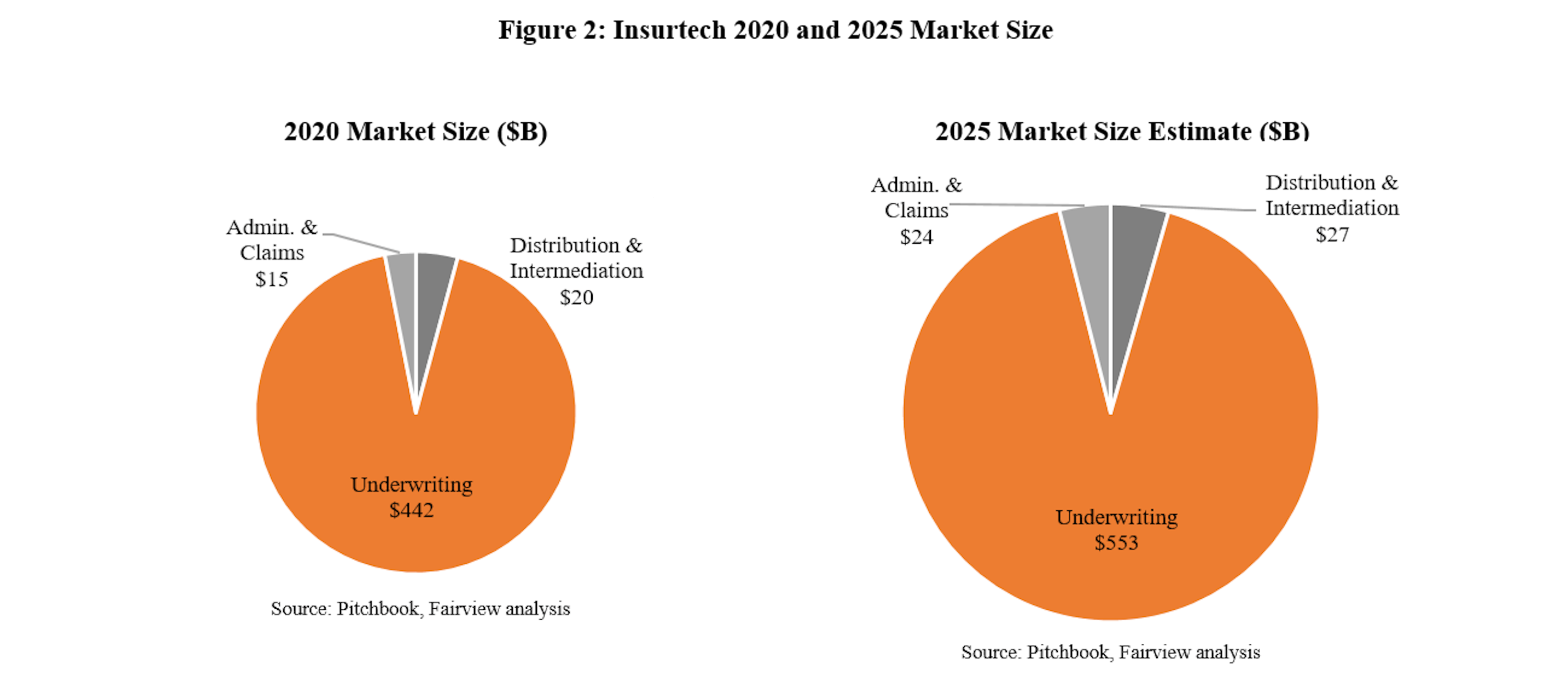

The insurance market is essential and enduring as a 400-year-old industry. Globally, the general insurance market’s direct written premiums were approximately $6.3 trillion in 2019, equating to 7.2% of the global GDP. The global insurance market of underwriting, distribution & intermediation, and administration & claims handling is expected to increase by an aggregate average of 26.7% through 2025.1 Technology opportunities remain plentiful – for example, only 5% of insurers utilize artificial intelligence within their underwriting processes.

In 2020, the cumulative global deal value across venture capital, private equity, and M&A for insurtech companies totaled approximately $18.3 billion. Additionally, five insurtech companies (Root Insurance, Duck Creek Technologies, GoHealth, Lemonade, and Huize.com) went public in 2020. There were ten insurtech unicorns as of year-end: Bright Health, Oscar, Hippo, Next Insurance, Gusto, Zenefits, Policy Bazaar, Wefox, Devoted Health, and Bind.

Underwriting

As the largest insurtech market, underwriting is poised for growth as insurance providers maximize profits. By 2025, the global market is predicted to reach $553 billion as more startups enter the space and the industry matures [1]. Technology provider incumbents such as Oracle, SAP, Pegasystems, and Mendix, offer risk assessment and analytics, portfolio strategy, and management solutions. Underwriting is one of the largest expenses for insurers. Companies in the segment have raised the most venture funding in 2020, with $555 million across 98 underwriting insurtech deals.[1] Insurtech startups focus on helping insurance providers with underwriting efforts by leveraging data, machine learning, and predictive analytics. This automation allows for higher levels of certainty and speed. Additionally, with insurtech, underwriting can average 80% in savings with full automation.[2]

Distribution and Intermediation

By 2025, the global market of distribution & intermediation is expected to grow to over $27 billion as the traditional broker and agent model shifts towards artificial intelligence-driven tools and other technological solutions.1Incumbent technology providers include ADP, Oracle, Marsh and McLennon Companies, AON, and Workday. They offer human resources benefits administration, and agent and broker portals. Incumbents can license technology from insurtech companies to compete with full-stack startups, but in many cases, insurtech companies collaborate with existing providers to maximize product offerings, eliminating the need for a traditional separate platform. In 2020, distribution & intermediation insurtech startups raised $1.3 billion across 135 deals.1Technology-based distribution solutions enable a simplified customer experience, including user-friendly interfaces, policy transparency, simple price comparisons, and on-demand customer support. This seamless experience attracts new consumers, such as millennials, Generation Z, and non-English speaking individuals.

Administration and Claims Handling

Insurtech companies focused on administration & claims handling reduce operating expenses for insurance providers. By 2030, most insurers will utilize automated claims handling and, by 2025, spending is expected to increase to $24 billion.1 Incumbent technology providers include Guidewire, Duck Creek Technologies, Sapiens, Majesco, and Insurity. These companies operate in the billing and collections, claims and settlement, and policy servicing segments of insurance. A 2019 EY survey found that 87% of policyholders state the claims experience affects their decision to renew with an insurer. The claims process is ripe for innovation, as insurers have historically hired adjusters to quantify liability claims. Most insurers have not yet automated their claims processing, positioning insurtech startups for strong growth and incumbents for cost savings. Demand for claims innovation has led to insurtech startups raising $478 million across 72 venture deals in 2020.1

Examples of Insurtech Companies Across the Value Chain

Underwriting

Insurance policy issuers continuously seek to improve underwriting to reduce losses. As previously stated, insurtech companies focused on underwriting leverage data, machine learning, and predictive analytics to help insurers automate underwriting procedures. Venture-backed Cape Analytics is an insurtech company in the Fairview portfolio focusing on risk assessment and analytics.

Fairview is an investor in Cape Analytics, the developer of a cloud-based data feed platform providing property intelligence for buildings. The company enables insurance providers to access on-site quality property detail at the time of underwriting. In January 2020, Cape Analytics raised $10 million through a Series B1 financing round by Brewer Lane and State Farm Ventures, at a pre-money valuation of $95 million.

Distribution and Intermediation

Insurtech is redefining distribution & intermediation through artificial intelligence and simplified software solutions. The newfound ease of purchasing insurance online allows consumers to submit an application and receive a quote in a matter of minutes; diminishing the role of in-person insurance agents. Venture-backed insurtech startups, Covr Financial Technologies and ThreeFlow, are two insurtech companies in the Fairview co-investment portfolio leveraging transparency and technology in the insurance market.

Fairview is a direct early-stage investor in Covr Financial Technologies (“Covr”), a digitally enabled brokerage agency for life, long-term care, and disability insurance. Covr offers financial institutions and advisers a comprehensive digital policy issuance platform. The company is well-positioned for growth as the platform expands. In 2020, Covr raised $7.5 million through a Series A financing round. In April 2021, Covr completed its latest funding round with an investment from Sony Innovation Fund. Co-investors include Allianz Life Ventures, Nyca Partners, and Commerce Ventures.

Fairview is a direct investor in ThreeFlow, the first Benefits Placement System allowing brokers and carriers to manage the entire placement process. ThreeFlow connects people, systems, and information to enable easier communication, a quicker process, and better decisions. The company raised $8 million of Series A funding from Emergence Capital Partners, Equal Ventures, and First Trust Capital Partners in January 2021. The company is well-positioned for growth and is using the funding for product development and general corporate development.

Administration and Claims Handling

Insurtech companies’ proprietary technology solutions lower expenses and increase customer satisfaction and retention for insurance providers. Insurtech startups such as Shift Technology (“Shift”) use artificial intelligence and automation to improve administration and claims processes.

Examples of Insurtech Companies Across the Value Chain

Underwriting

Insurance policy issuers continuously seek to improve underwriting to reduce losses. As previously stated, insurtech companies focused on underwriting leverage data, machine learning, and predictive analytics to help insurers automate underwriting procedures. Venture-backed Cape Analytics is an insurtech company in the Fairview portfolio focusing on risk assessment and analytics.

Fairview is an investor in Cape Analytics, the developer of a cloud-based data feed platform providing property intelligence for buildings. The company enables insurance providers to access on-site quality property detail at the time of underwriting. In January 2020, Cape Analytics raised $10 million through a Series B1 financing round by Brewer Lane and State Farm Ventures, at a pre-money valuation of $95 million.

Distribution and Intermediation

Insurtech is redefining distribution & intermediation through artificial intelligence and simplified software solutions. The newfound ease of purchasing insurance online allows consumers to submit an application and receive a quote in a matter of minutes; diminishing the role of in-person insurance agents. Venture-backed insurtech startups, Covr Financial Technologies and ThreeFlow, are two insurtech companies in the Fairview co-investment portfolio leveraging transparency and technology in the insurance market.

Fairview is a direct early-stage investor in Covr Financial Technologies (“Covr”), a digitally enabled brokerage agency for life, long-term care, and disability insurance. Covr offers financial institutions and advisers a comprehensive digital policy issuance platform. The company is well-positioned for growth as the platform expands. In 2020, Covr raised $7.5 million through a Series A financing round. In April 2021, Covr completed its latest funding round with an investment from Sony Innovation Fund. Co-investors include Allianz Life Ventures, Nyca Partners, and Commerce Ventures.

Fairview is a direct investor in ThreeFlow, the first Benefits Placement System allowing brokers and carriers to manage the entire placement process. ThreeFlow connects people, systems, and information to enable easier communication, a quicker process, and better decisions. The company raised $8 million of Series A funding from Emergence Capital Partners, Equal Ventures, and First Trust Capital Partners in January 2021. The company is well-positioned for growth and is using the funding for product development and general corporate development.

Administration and Claims Handling

Insurtech companies’ proprietary technology solutions lower expenses and increase customer satisfaction and retention for insurance providers. Insurtech startups such as Shift Technology (“Shift”) use artificial intelligence and automation to improve administration and claims processes.

Fairview is an investor in Shift Technology, the provider of a SaaS solution for insurance companies to improve and manage the claims process. The platform includes an artificial intelligence fraud detection tool, designed to improve the fraud detection and management process. Shift’s most recent Series D financing round was led by Advent International in May 2021 at a $1 billion post-money valuation. Co-investors include Accel, Bessemer, General Catalyst, Avenir Growth Capital, and Iris Capital. Shift is leveraging the proceeds to double down on growth and expand in the health and property & casualty insurance segments.

Full Stack

Some insurtech companies leverage all three areas of insurance innovation in addition to offering insurance policies. These full-stack insurtech companies – Fairview portfolio companies Lemonade and Eden Health – are reinventing the insurance offering process.

Fairview is an investor in Lemonade, a full-stack artificial intelligence-based insurance company offering coverage for renters, homeowners, pets, and life insurance. The company also provides policy issuing and claim settlement services. Lemonade went public in July 2020 at a valuation of $1.6 billion. Prior investors include Menlo Ventures, General Catalyst, XL Innovate, and others. In 2020, Lemonade generated almost $95 million of revenue, an increase of 40% year-over-year. In 2021, the company announced plans to expand into car insurance before the end of the year.

Fairview is an investor in Eden Health, an operator of a primary care and insurance navigation enterprise platform. The platform allows employees to understand their insurance policy, and provides options for in-person and virtual care. Eden Health’s Series C round was led by Insight Partners in February 2021, resulting in a $370 million post-money valuation. Flare Capital Partners, Aspect Ventures, Company Ventures, and others also participated in the round. The demand for Eden Health’s platform has increased by over 500% since the COVID-19 outbreak.3

Acceleration of Venture Capital Investment

The insurtech industry is experiencing accelerated venture capital attention and investment. Only five years ago, venture insurtech investment totaled just $520 million across 88 deals.1 In 2020, $6.1 billion was invested across 399 deals, despite a slight decrease in capital investment due to a COVID-19 slowdown in the first half of the year.1 However, insurtech investment rebounded and hit a quarterly high of $2.6 billion in the first quarter of 2021. There were ten insurtech unicorns as of December 31, 2020, and three previous unicorns went public during 2020: Root Insurance, Lemonade, and Clover Health.

Insurtech companies are beginning to mature. Lemonade, an app-based renters and homeowners policy provider, went public in July 2020 as the industry’s first pure-play insurtech IPO. Further, the nation’s first licensed insurance career providing an online car insurance platform, Root Insurance, went public in October 2020. Lastly, Clover Health and Eden Health both went public in early 2021. Investors should expect to see more IPOs in the outer years.

To date, the most active venture firms in the insurtech space include Anthemis Group, New Enterprise Associates, General Catalyst, Ribbit Capital, Accel, and Founders Fund; each attributable to over 16 insurtech deals. More recently, firms focused on insurtech have come to market, such as Brewer Lane Ventures and Eos Venture Partners. We find that general partners in insurtech are early-stage technology investors. Many have deep technology backgrounds, and we are seeing an uptick in investors with insurance backgrounds. We expect venture capital firms to hire individuals with insurance expertise to capitalize on the evolving opportunity set.

Many strategic buyers have also started recognizing the potential in the insurtech space. Companies such as Arthur J. Gallagher & Company, Versik Analytics, Applied Systems, Insurity, Seeman Holtz Property & Casualty, and Sapiens International have all participated in six or more insurtech deals. Additionally, insurance providers such as Mass Mutual, Aetna (CVS), Nationwide, and others have created venture funds. As corporations and private companies strategize insurtech applications, there will likely be an increase in strategic players.

Fairview Exposure

Fairview has built direct and indirect exposure to leading insurtech companies through 60 insurtech deals and 32 unique companies. Fairview’s insurtech companies are held at an aggregate return of 3.5x to date.[4]

Additionally, Fairview has recently observed a rise in new insurtech-focused funds in its proprietary pipeline. Fairview expects more insurtech-focused funds and investors to emerge in the category over time as it grows.

Outlook

Fairview is confident that insurtech will transform the insurance industry. We have steadily developed exposure to the insurtech industry and will continue to do so going forward, including through funds focused on the category and pursuing fintech or insurtech as a general theme. We expect increased M&A activity as insurance companies optimize crucial legacy changes. Investors should monitor insurtech trends in the marketplace and be strategic about how they develop exposure. Remaining informed and approaching the category tactically will be vital for limited partners with sophisticated venture capital portfolios. Fairview believes giving strong consideration to dedicated insurtech funds or building exposure through generalist funds with theses and resident expertise in the insurtech category are two approaches with merit to investing successfully in this exciting area.